A step-by-step explanation of Payroll Processing

What is Payroll Processing & It’s 3 Stage:

Payroll processing is an essential business function that involves arriving at the ‘net pay’ of the employees after the adjustment of necessary taxes and deductions. For an efficient payroll management process, the payroll administrator needs to plan the payroll process step-by-step.

What is Payroll Processing?

Payroll processing in HR is an elaborate process that involves a lot more than salary calculations. The process can be intimidating if you do not know how to go about it which is exactly why this handy guide will navigate you through the intricacies of payroll processing.

What is the meaning of Payroll Processing?

Payroll processing is an essential business function that involves arriving at the ‘net pay’ of the employees after the adjustment of necessary taxes and deductions. For efficient payroll management process, the payroll administrator needs to plan the payroll process step-by-step.

*Note

Net pay = Gross income – Gross deduction

Here,

Gross income/Salary = Regular Income + Allowances + One-time payment/ Benefit

Gross deduction = Regular deductions + Statutory deductions + One-time deductions

What does Payroll Processing encompass?

Here’s a list of tasks the payroll administrator needs to accomplish during payroll processing.

- Develop the organisation’s pay policy that includes flexible benefits, leave encashment policy, and more

- Define payslip components – basic and variable pay, HRA, LTA, etc.

- Collect other payroll inputs from the transport service provider or the food/canteen vendor

- Arrive at the net pay by calculating gross salary and deducting the statutory and non-statutory sums

- Finally, release employee salary.

- File returns and deposit dues such as TDS, PF, and more, with respective authorities.

A step-by-step explanation of Payroll Processing in India

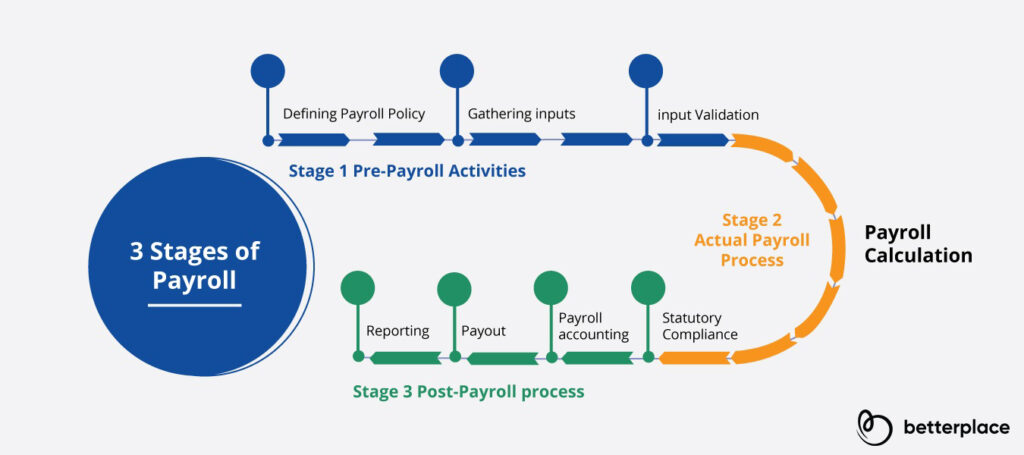

The entire payroll procedure is divided into 3 stages.

STAGE 1: Pre-Payroll Activities

-

Defining payroll policy

This is the first stage wherein you establish policies to bank on during the payroll process. To turn these policies into standards, they need to be approved by the management. Examples of such policies are – pay policy, attendance policy, leave and benefits policy, and more.

-

Gathering inputs

The next step is to gather inputs from various departments to ensure accurate calculation of payroll.

| DATA SOURCE | DATA EXAMPLE |

| Employees | Income tax declaration, facilities availed, and more. |

| HR team | Salary structure, eligibility for benefits, etc. |

| Finance team | Deduction for recoveries. etc. |

| Leave and attendance systems | Data from attendance systems, current work shift, etc. |

| General service providers | Transport service provider, canteen vendor, and more. |

All this data collection can seem overwhelming at first. You must, therefore, incorporate payroll software which comprises features such as leave and attendance management, ESS (Employee Self Service portal) and more to make it hassle-free.

-

Input validation

Once you’ve finished gathering all the required data, you need to verify its validity. Because a single mistake here can cause ruin the entire payroll process.

- Ensure that the list contains all the active employees and no records of inactive employees.

- Check that data adheres to the company policy.

- Ensure the data present in the right format.

Stage 2: Actual payroll process

-

Payroll calculation

Now that you have the verified data, its time to feed it into the payroll system. The result you get will be the net pay after the adjustment of necessary taxes and deductions. In this step, you recheck the process again to nullify chances of errors.

What is a Payroll System?

A payroll system is a software to automate the payroll process. These systems can be integrated with leave and attendance tracking systems and employee self-service portal and are used to keep track of employee’s working hours, calculate salaries, calculate taxes and deductions, print payslip, etc.

Payroll software, thus, minimizes employers’ efforts so that they can focus on more pressing problems of the business.

Stage 3: Post-payroll process

-

Statutory compliance

During the payroll processing, the payroll administrator needs to religiously adhere to the statutory compliances. Various statutory deductions – EPF, TDS, ESI – are deducted during payroll processing. These deductions are then paid to the respective authorities/government bodies.

-

Payroll accounting

Every organisation needs to maintain an accurate book of accounts. And the salary paid is one of its significant entries. Therefore, as a step of the payroll process, all salary data must be fed into the accounting or ERP system.

-

Payout

After all these steps, you can finally pay salaries via cash, cheque, or bank transfers. It is preferable to have salary accounts of employees for hassle-free transfers. For payment to salary accounts, you need to send salary bank account statements with particulars such as employee ID, account number, salary amount, etc., to the branch.

-

Reporting

The last step is to prepare accurate reports containing information such as department or location- wise employee cost. These reports are then sent to the finance department or the management team for further analysis.

These are what goes into the making of an efficient payroll process in India. Now that you know the procedure in detail, make sure to leverage the information and amplify your organisation’s efficiency.

What are the contemporary trends in the website designing you need to know?

Email : info@rayafeel.com

Phone : +91 72000 04025 / +91 88389 53252 /+91 84220 89238/+91 81483 83856

Address : Spencer Plaza, S102, 2nd floor, Phase-3, Door No. 769, Anna Salai, Chennai, Tamil Nadu, 600002

Have any question? (+91)8838953252 ITsupport@rayafeel.com

Our services can also remind you through our website.

We even have Facebook, Instagram and Linked in! Comment or like if your more of the social media type 😉