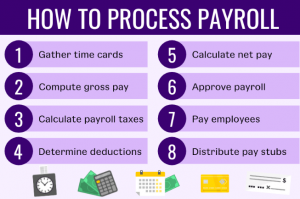

How to Process Payroll in 8 Straightforward Steps in Rayafeel.

Part of your title as “employer” also includes “payroll processor.” When you hire employees, you have to add them to payroll, withhold the proper taxes, and pay employees. It’s all part of the job. But if you’re new to this employer role, you may not be exactly sure how to process payroll. Well lucky for you, we’ve written down the steps so you can become a pro at payroll processing in no time flat.

Before processing payroll…

Woah, woah, woah—before you can even think about running payroll, you need to gather some information. To process payroll, you need to do following:

- Apply for an Employer Identification Number (EIN)

- Get state and local tax IDs

- Collect Form W-4 and a state W-4 form (if applicable) from employees

- Choose a pay frequency or frequencies (e.g., weekly, biweekly, monthly, etc.)

- Determine how you will run payroll

- By hand

- Payroll software

- Tax professional

- Get employee direct deposit info, if applicable

If you’re a seasoned employer, you don’t have to worry about these tasks. But if it’s your first rodeo, you’ll need to put in the legwork prior to processing payroll.

How to process payroll

Depending on how you run payroll (e.g., payroll processing software), your steps for handling payroll may vary. For example, if you use payroll software, the program typically does the payroll tax calculations for you. But if you do payroll by hand, you need to do your own calculations.

So, how do you process payroll? Generally, you will need to follow these eight steps to process payroll:

1. Gather time card information

Depending on your business and if your employees are salaried or hourly, you may have some or all employees clock in and out and record their information on a time sheet. For hourly employees, you need to know their hours so you can pay them properly. And, you may need to do the same with salaried employees, especially if they’re nonexempt.

Before you can calculate gross pay and payroll taxes, determine deductions, etc., collect time cards from applicable employees. The time cards let you know how many hours each employee worked and if you owe them any overtime (if they’re nonexempt).

You can have employees fill out a paper time sheet for their hours, punch in and out through a time clock, or fill out their hours using time and attendance software.

2. Compute gross pay

After you collect time cards from applicable employees, calculate each employee’s gross pay, which includes any overtime wages. If you use payroll software, the software handles this step for you (including overtime calculations).

For hourly employees, you can calculate gross wages by multiplying the hourly wage by the number of hours worked in the period. For salaried employees, their gross pay is generally the same each period unless they earn overtime or other additional wages.

Overtime is 1.5 times an employee’s regular pay rate for each hour worked over 40 in a workweek (unless state overtime laws say otherwise). Keep in mind that calculating overtime for salaried employees is different than computing it for hourly workers.

If you have any bonuses, reimbursements, etc., be sure to include those in your employees’ gross wages, too.

3. Calculate payroll taxes

You’re not quite done calculating just yet. Next, calculate each employee’s payroll taxes. Again, using payroll software or a tax professional can help simplify this step.

Depending on the employee’s W-4 information and location, taxes can vary. You may need to withhold the following taxes:

- Social Security tax: 6.2% up to the Social Security wage base

- Medicare tax: 1.45% (or 2.35% with the additional Medicare tax rate of 0.9%)

- Federal income tax: Based on Form W-4 information

- State income tax: Based on W-4 information

- Local income tax: Varies by locality

- SUI tax: For employees in Alaska, New Jersey, and Pennsylvania

- State-specific taxes: Varies by state

As an employer, you’re also responsible for contributing to certain taxes, such as Social Security, Medicare, federal unemployment (FUTA), and state unemployment (SUTA) taxes.

4. Determine employee deductions

Along with withholding taxes from employees’ paychecks, you may also need to subtract deductions. Employee deductions can be pre-tax or post-tax, depending on what they are. Some common deductions include:

- Wage garnishments

- Health insurance premiums

- Life insurance premiums

- Retirement plans

- Job-related expenses

If your employee has any deductions, make sure to deduct them accordingly. If you use payroll software, you can typically set up deductions so that they automatically deduct each pay period.

5. Calculate net pay

After you calculate gross pay, withhold payroll taxes, and determine deductions, you can calculate your employees’ net pay. An employee’s net pay is how much they take home after taxes and deductions.

To find net pay, simply deduct taxes and deductions from the employee’s gross pay. Use the following formula, if needed:

Gross Pay – Payroll Deductions = Net Pay

If you’re not doing payroll by hand (aka using software or a professional), you don’t have to worry about computing net pay yourself.

6. Approve payroll

Calculate each employee’s net pay? Great! Now you can approve payroll. But before you do that, be sure to double-check your calculations to ensure that they’re accurate. If you use payroll software, consider also checking over everything one more time to ensure that you input everything correctly (e.g., employee hours).

If everything looks good on your end, you can approve payroll and begin to…

7. Pay employees

Now comes the fun part: paying your employees. There are a variety of payment options to choose from, including:

- Direct deposit

- Cash

- Pay cards

- Checks

- Mobile wallet

You may decide to give employees an option about which method they want to use (e.g., direct deposit vs. check). Regardless of which method(s) your business uses, be sure to pay employees using your chosen pay frequency. And, make sure your frequency aligns with pay frequency requirements by state.

8. Distribute pay stubs

Last but not least, after you pay your employees, distribute pay stubs. You can distribute paper stubs to your team in person or via mail. Or, you can give employees access to electronic pay stubs that they can access through a software or employee portal.

Whatever method you choose, make sure your employees have a way to view a breakdown of what was deducted from their pay for their records.

Advantages of PostgreSQL In Transforming Environment